Our Process

You Have A Tax Problem.

In fact, most people do, they just don't realize it.

Odds are, your taxes are too high, which means you're sacrificing cash that could be invested in your business and personal goals.

The tax code is complex and you don’t know what you don’t know. That's OK because we do. You're busy running your business. Tax reduction is our business. Let us help you find opportunities to keep more of what you earn and help you grow.

Tax Strategy, Not Tactics

At C&A, we don't "do your taxes". We execute a comprehensive analysis of your situation develop a true tax reduction strategy that can help you infuse cash in the short term and leverage savings into substantial long-term returns.

Start Your Free Tax Assessment

If reducing your taxes, keeping more of what you earn, and turning those savings into wealth are important to you, we can help.

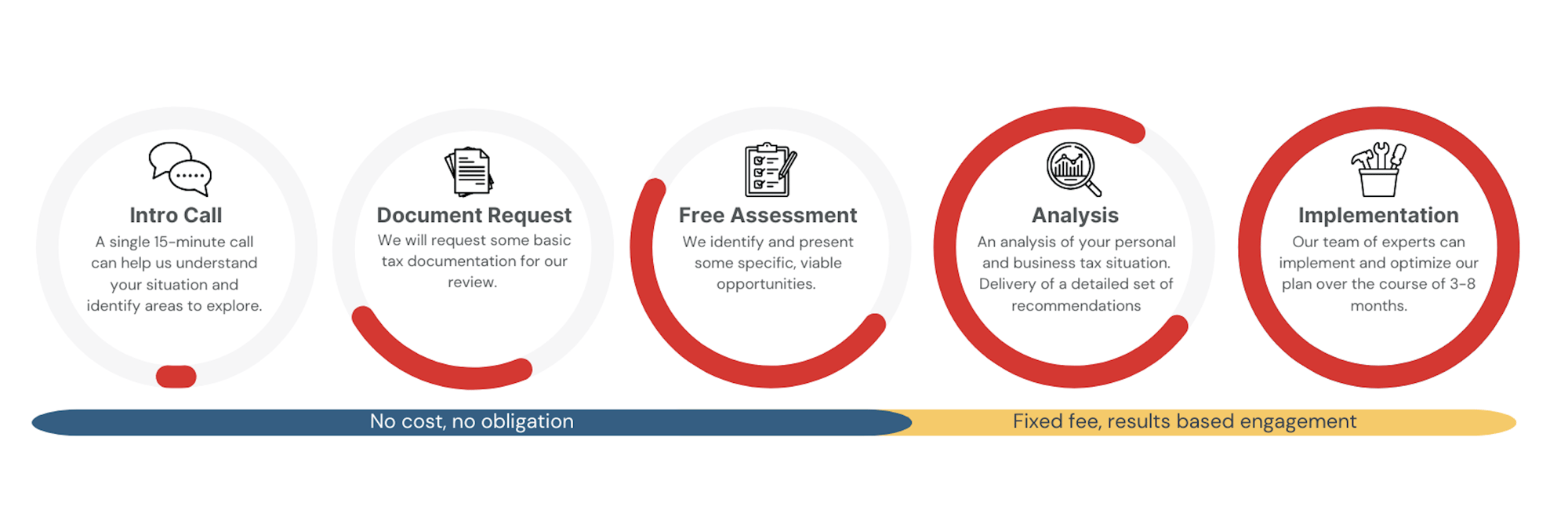

Our no-cost, no-obligation Tax Assessment, conducted by our team of tax professionals, offers valuable insights into your tax situation. The Assessment provides a better understanding of your tax exposure, and uncovers opportunities for optimizing entity structure, leveraging advantageous financial products, estate planning, and more.

Our Enhanced Business Analysis

Our team of experts conducts a thorough analysis of your entire tax situation and creates a comprehensive strategy that goes beyond specific tax incentives and credits. We offer professional guidance to safeguard your assets, optimize your organizational structure from a tax perspective, and help you plan for transition or exit. It all begins with a 15-minute call.

Marginal & Effective Tax Reduction

Reducing tax rate for additional income through deductions, credits, and exemptions and minimizing your overall tax burden by optimizing your entire tax situation through careful financial planning and compliance with tax laws.

Asset Protection

Secure your financial future and leave a lasting legacy by proactively protecting your assets from excessive taxes.

Real Estate Investment Opportunities

Through strategies like cost segregation studies and energy efficiency credits for residential and commercial properties, you can save a substantial amount on your tax bill.

Learn more about 45L credits for energy-efficient residential properties

Learn more about 179D credits for energy-efficient commercial properties

Learn more about Cost Segregation

Exit & Estate Position

Planning for estate taxes is an important step to safeguard your wealth and ensure a smooth transition of assets upon your exit or passing.

Business Structure

Identifying the optimal business structure to minimize your tax liabilities. Interpreting federal and state laws to guide you toward the most tax-efficient structure.

Owner Compensation/Nature of Income

Optimizing owner compensation for tax purposes allows you to maximize income while minimizing tax liabilities.

Employee Benefit Optimization

Optimizing employee benefits not only enhances employee satisfaction and productivity but also offers significant tax benefits for businesses. Programs like Secure 2.0 can help offset the cost of setting up a new plan and make it easier to hire and retain top talent.

Retirement Account Optimization

With strategically tailored retirement plans, you can maximize your savings and minimize your tax liability. Programs like Secure 2.0 can help offset the cost of setting up a new plan and make it easier to hire and retain top talent.

Our Simple, Rapid Process

Tax Services We Provide:

Specialty Tax

Expert guidance to navigate complex tax regulations, minimize tax liabilities, and stay ahead of tax law changes.

- R&D Credits

- Cost Segregation

- 179D

- 45L

- IC-DISC

- Automatic Accounting Changes

Tax Consulting

Highly valuable organizational strategy, planning, and training.

- Income Tax Reduction Strategies

- Entity Restructuring

- SECURE 2.0 Plan Optimization

- Balanced Compensation Advisory

- Valuation for Tax

- Passive Investment Strategies

- Pass-Through Taxation Enhancement

Wealth Advisory

Tax strategy, planning advice, and financial products for clients to grow and preserve their wealth while achieving their financial goals.

- 401(k) Optimization for Tax Credits

- Cash Balance Pension Plans

- Executive Compensation Planning

- Executive Benefits Planning

Risk Advisory

Highly valuable organizational strategy, planning, and financial products.

- Asset Protection Strategies

- Asset Valuation Services

- Tax Liability Risk Mitigation

- Buy/Sell Review & Implementation

- SPE & Trust Utilization

Exit Planning

Support for mergers, acquisitions, or other significant financial transactions to help make informed decisions.

- Succession Planning

- Market Analysis

- Due Diligence

- Pre & Post Transaction Tax Planning

- Tax Restructuring

- Business Valuations

Estate Planning

Minimizing the tax liabilities associated with transferring assets to beneficiaries.

- Estate Tax Reduction Strategies

- Asset Protection

- Estate Freezing Techniques

- Estate Reduction Techniques

- Legacy Planning

- Philanthropic Planning

- SPE & Trust Structuring

Our Model

Simple, deliverable-based fixed fee pricing

- No secrets, no surprises. We believe in transparency, we are performance-based and we are easy to work with.

- We are fixed fee. All of our engagements are fixed fee aligning our projects to your return on investment.

- We are results-based. All of our projects are results based, which drives performance not just effort.

By the Numbers

$0B+

0%

0K+

0%

What our clients say about C&A.

"They coach business owners to really implement critical strategies…they can look at your operation, figure out your returns, and then figure out the efficiencies that you can implement in order to save money."

Jonas Angus, President, TPE Solutions

Our Latest Articles and Resources

Schedule a consultation today

If you're ready to solve your tax problem, set up a 15-minute call with our team today. Let's work together to get you on the path to keeping more of what you earn.