The C&A Blog

The latest insight from our team of experts on taxation, tax law, financial planning and wealth optimization.

- All

- Tax Strategies

- Small Business

- Tax Savings

- Business Valuation

- Growth to Goal

- Specialty Tax Credits

- Advanced Estate Planning

- Business exit

- Estate Tax

- Cost Segregation

- Exit strategy

- Tax Benefits

- R&D Tax Credit

- Advanced Entity Structuring

- Real Estate Tax Strategy

- ERTC

- Investing

- Training and Consulting

- Executive Compensation Studies

- Automatic Accounting Changes

- Brand Equity

- Tax Efficient Investing

- Path Act

- QBI

Posts about Business Valuation:

"Golf is deceptively simple and endlessly complicated." Arnold Palmer. The same can be said...

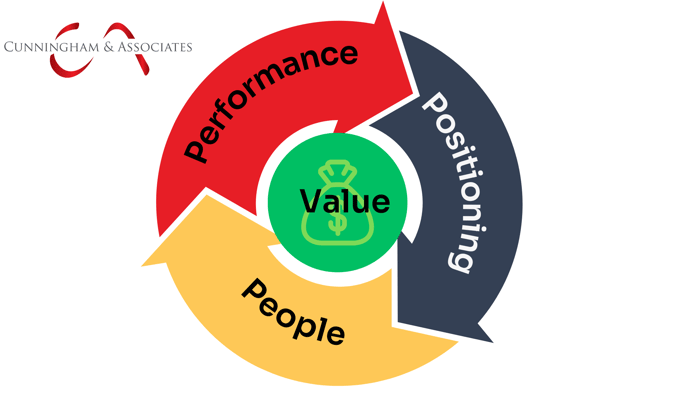

For business owners, conducting a thorough valuation is not just about setting a price for your...

Selecting the appropriate valuation method is essential for business owners as it plays a...

When you are planning your estate, two primary concerns are protecting your assets and shielding...

One common mistake in business valuation is forgetting to consider intangible assets. Intellectual...

You can't own and operate a business effectively without a business valuation. A business valuation...

A business valuation is an important resource for a business owner. The process can be complex and...

Recently, we discussed the risks of not having a proper business valuation - and there are many. Of...

According to a study from M&T Bank, 98% of small business owner do not know the value of their...

Investing in real estate can be complicated. Owning both commercial and residential property can...

Don't Wait, Set Up A Time To Talk With Our Team Today.

Every dollar you pay in taxes is a dollar you won't be able to invest in your future. A 15 minute call could change your financial future.

.png?width=1400&name=pillars%20(7).png)

.png?width=341&height=100&name=www.jec-llc.comhs-fshubfslogo%20(2).png)