The Role of Tax Advisory in Multigenerational Planning

.png?width=50&name=Untitled%20design%20(50).png)

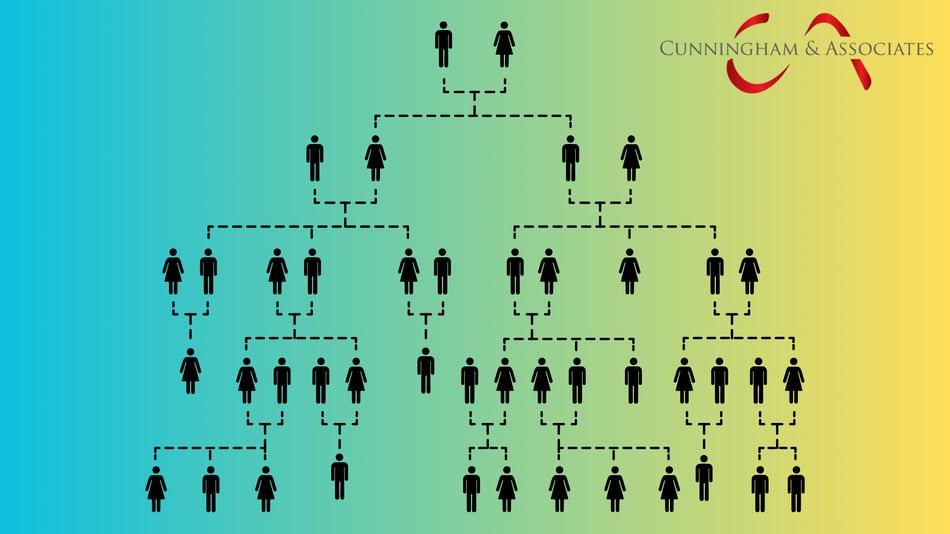

When it comes to preserving and growing wealth across generations, tax advisory plays a crucial role. For high-net-worth individuals, planning for the future isn't just important—it's about creating a lasting legacy. Let's explore how tax advisory can make a big difference in multigenerational financial planning.

Understanding Multigenerational Wealth Planning

Multigenerational wealth planning is all about crafting strategies that help pass wealth from one generation to the next, while keeping tax burdens low and family values intact. It covers everything from estate planning and investment management to philanthropy and business succession planning, with taxes playing a key role in each area.

Tax Advisory in Multigenerational Planning

-

Minimizing Estate Taxes

- Estate taxes can significantly erode wealth from one generation to the next. Tax advisors help structure estates to leverage exemptions and deductions, such as the gift tax exemption and generation-skipping transfer tax exemption.

- Techniques such as trusts, family limited partnerships, and charitable giving are employed to reduce taxable estate size, ensuring more wealth is transferred to heirs.

-

Strategizing Gift and Trust Instruments

- Trusts effectively manage wealth and provide for future generations while minimizing taxes. Tax advisors help set up and manage various types of trusts, such as revocable, irrevocable, and generation-skipping trusts, each with specific tax considerations.

- Smart gifting strategies can shift assets tax-efficiently, gradually transferring wealth and reducing estate tax liabilities.

-

Business Succession Planning

- For families with business holdings, tax advisors play a critical role in succession planning. They help navigate the complexities of transferring business ownership, structuring buy-sell agreements, and utilizing valuation discounts.

- In some cases, crafting employee stock ownership plans (ESOPs) can provide liquidity while offering tax advantages.

-

Philanthropy and Charitable Planning

- Charitable giving can be both a philanthropic choice and a tax strategy. Tax advisors help design charitable remainder trusts, donor-advised funds, and family foundations that can provide tax relief and align with philanthropic goals.

- Strategic philanthropy helps reduce income and estate taxes while leaving a lasting legacy aligned with family values.

-

Comprehensive Tax Planning

- Tax advisors offer insights into current tax regulations and anticipate changes in tax laws that could impact long-term wealth plans.

- This proactive approach includes tax-efficient asset location, income-shifting strategies, and leveraging tax credits and deductions to protect family assets over time.

The Value of Engaging Skilled Tax Advisors

-

Expertise and Insights: Tax advisors bring a wealth of knowledge on complex tax codes and strategies that can significantly benefit high-net-worth families. Their expertise ensures that wealth transfer aligns with both legal requirements and personal goals.

-

Personalization: Every family’s financial situation and aspirations are unique. Tax advisors tailor strategies to fit specific family dynamics, business interests, and legacy aspirations.

-

Risk Management: By identifying and mitigating potential tax liabilities, tax advisors help protect family wealth from unforeseen tax events that could diminish resources.

-

Continuity and Peace of Mind: Comprehensive tax planning ensures that structures are in place for seamless transitions, easing potential family disputes and providing peace of mind about future financial security.

Conclusion

For those with significant wealth, planning for future generations is critical to mitigate exposure. Tax advisory is a vital part of this journey, providing smart strategies and practical solutions to safeguard and grow family wealth. By working with skilled and experienced tax advisors, families can confidently pass on their legacy, ensuring it flourishes for years to come. In the end, the true value of tax advisory in multigenerational planning is in preserving wealth, upholding family values, and offering peace of mind.

.png?width=341&height=100&name=www.jec-llc.comhs-fshubfslogo%20(2).png)

.png?width=50&name=Ryan%20Foley%2c%20Partner%20(5).png)