We don’t mean this literally of course, but it’s time to stop thinking about your taxes in terms of filing and compliance.

Filing and compliance are procedural, table stakes, not strategic.

Think about it, you’re a successful person, strategic about your business, how and where you invest, and how you save.

But your financial strategy is critically flawed if it doesn’t extend to your taxes.

It’s the classic leaky bucket.

What Causes Leaks In Your Financial Strategy Bucket?

Exposure and neglect lead to corrosion, corrosion causes leaks and destroys the structural integrity of your bucket.

Going through the motions of filing each year without accounting for changes in the tax code, changes in your personal and professional situation, and accounting for your goals corrodes your bucket and causes more leaks.

Over time, those leaks get bigger, new ones spring, and even if your earnings increase, filing the bucket gets harder and harder.

And consider what happens when you’re no longer adding to the bucket.

To stop and repair the corrosion of your bucket, you have to understand the elements that cause it. There are four:

- Unnecessary Tax Exposure.

- Defective Compensation Structure.

- Inefficient Investment Strategy.

- Inadequate Exit and Estate Planning.

Unnecessary Tax Exposure

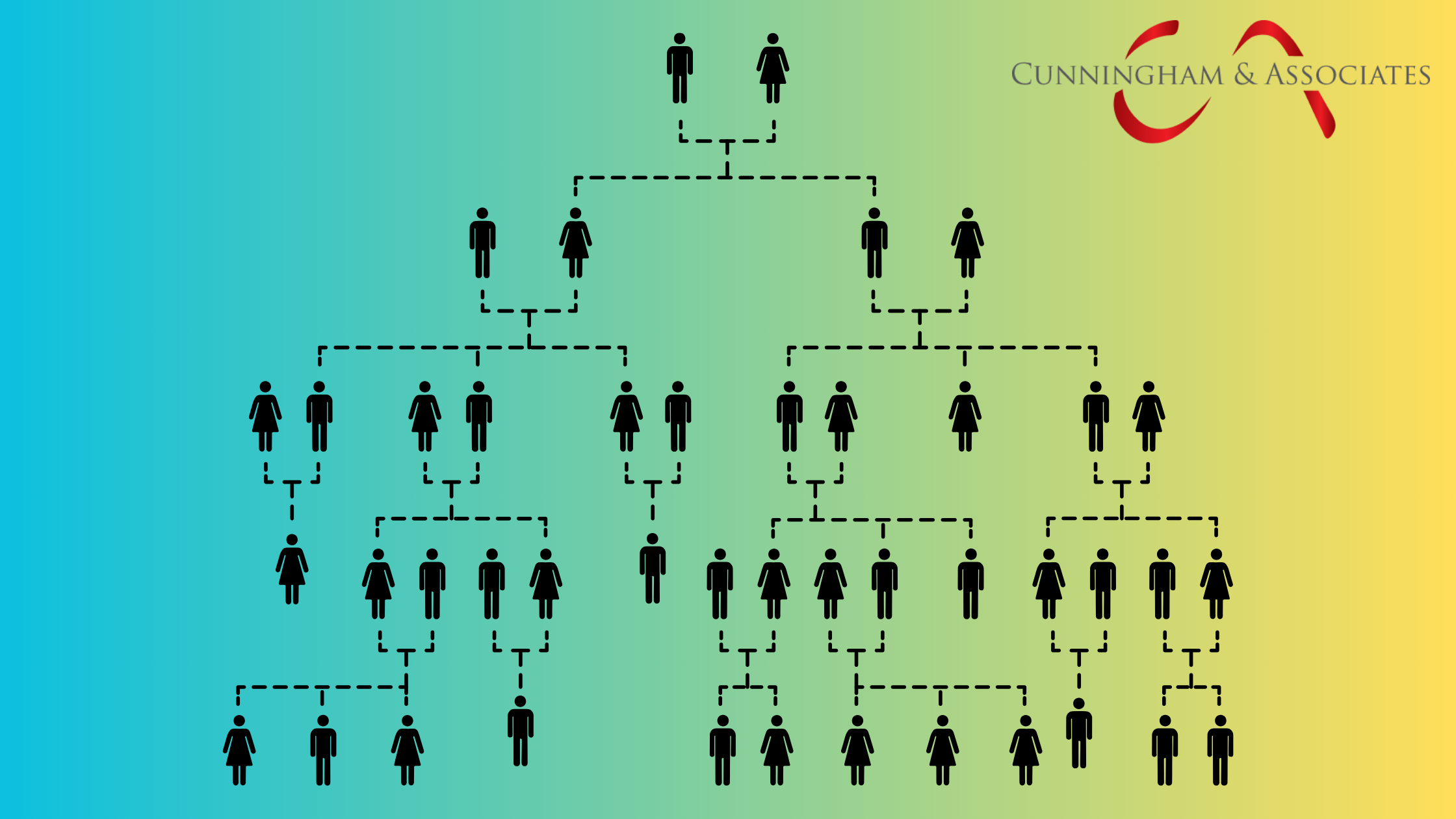

Every dollar lost to taxes is gone, unrecoverable. In the short term, taxes kill cash flow that could be used to fuel new growth in your business or personal life. We all know cash flow is the lifeblood of small business. In the longer term, earnings lost to taxes cannot be compounded through investing, decreasing the value of your estate and what you can pass down to future generations.

Defective Compensation Structure

We see it often, the owner of a business believes that as the owner they should be paid the most - and you should be - but it’s not just about how much you take out of your company, rather it’s about HOW. For example, taking a high salary and not optimizing how you leverage your benefits vs. taking distributions can increase personal tax burdens. Furthermore, entity structure plays a critical role in determining the tax implications of compensation. For instance, owners may face double taxation on dividends with a C-corporation, while S-corporations allow income to pass through directly to reduce overall taxes.

93% of business owners are overpaying their taxes, mistakes related to compensation and entity structure are the primary driving factors.

Inefficient Investment Strategy

A tax-inefficient investment strategy can diminish returns and long-term growth potential. Ignoring tax implications may lead to unnecessary capital gains taxes and missed opportunities with tax-advantaged accounts like IRAs and 401(k)s. This oversight increases taxes on dividends and interest, affecting net gains. Neglecting tax-efficient planning undermines your ability to build wealth.

Inadequate Exit and Estate Planning

98% of business owners don’t know the true value of their business and 75% have not done any estate planning. This is a recipe for disaster. Your business likely makes up the majority of your wealth and your exit and estate plans must be structured to maximize and protect that. Without a plan in place, you may never realize your business's true value at exit and that value will be further reduced by excessive estate tax burdens.

Sealing The Leaks In Your Financial Bucket

Day after day, we speak with people who believe they are doing everything right by working with their CPA and filing a technically accurate return.

The truth is, you’re probably filing an accurate return and protecting yourself from audits and penalties. But more often than not, that return is littered with missed opportunities - leaks in the bucket.

Tax filing is a commodity.

Tax strategy is a service that delivers real, tangible, compounding value. That’s why at C&A we continuously optimize our client's tax strategies and plans. We meet monthly, quarterly, whatever it takes to ensure they're positioned to minimize tax exposure and maximize their wealth.

If you think your tax strategy is “good enough”, we probably aren’t the best fit for you. But if you’re ready to get serious about a 360° strategy that can help you build and protect generational wealth, talk with our team today.