When you think about a tax advisor, your first thought is probably about filing annual returns. But, a seasoned tax advisor is much more than just a compliance expert; they are your strategic ally, enhancing and streamlining various facets of your business operations and personal financial well-being. From financial planning to business structuring and even crafting exit and estate strategies, here's how a skilled tax advisor can elevate your small business's performance and ensure its enduring success.

1. Comprehensive Financial Planning

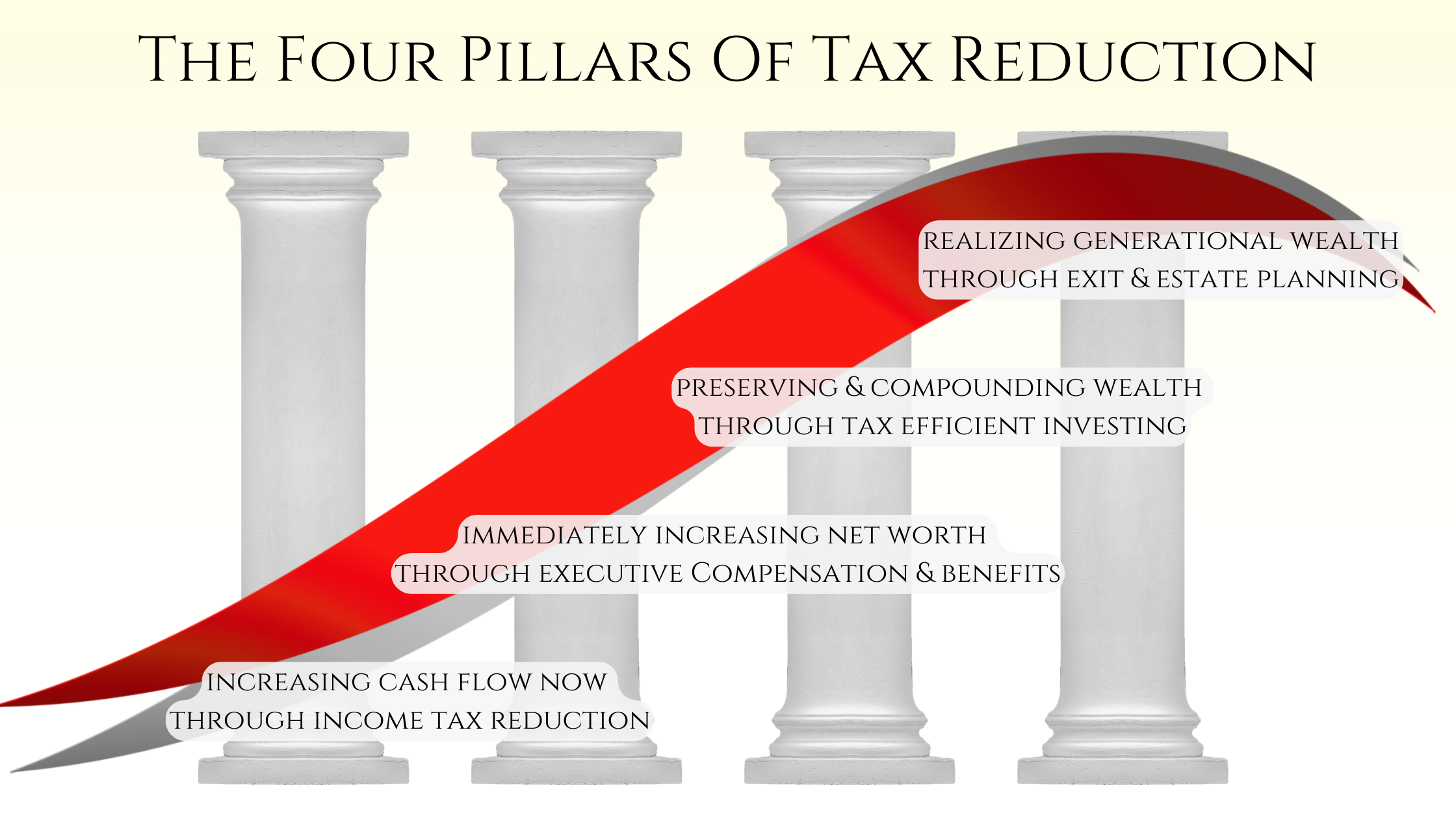

Financial well-being is the cornerstone of any thriving business, and a tax advisor is instrumental in establishing and maintaining this stability. They can guide you in budgeting, forecasting, and managing cash flow, empowering you to make informed financial choices. By optimizing your financial strategies, a tax advisor ensures you're equipped for future challenges and opportunities.

2. Efficient Business Structuring

Selecting the right business structure—be it a sole proprietorship, partnership, LLC, or corporation—can profoundly affect your tax obligations, legal duties, and operational flexibility. A tax advisor can assess your business model and aspirations to recommend the most tax-effective structure.

3. Strategic Tax Advisory

Beyond basic compliance, tax advisors can execute strategic tax planning to minimize liabilities and maximize savings. They keep abreast of the latest tax laws and incentives, enabling your business to capitalize on deductions, credits, and other opportunities.

4. Planning for Exit

An insightful exit strategy is vital for business owners contemplating retirement, succession, or selling their business. A tax advisor can guide you through business valuation, sale preparation, and transaction structuring to minimize tax impacts.

5. Estate Planning

For many business owners, personal and business finances are intricately linked, making estate planning an essential. A strong tax partner can help structure your estate to preserve your legacy, minimize tax liabilities, and ensure your assets are distributed according to your wishes.

6. Risk Management and Compliance

Adopting a proactive stance on risk management and compliance can protect your business from costly legal issues and penalties. Tax advisors offer insights on regulatory compliance, internal controls, and risk evaluation.

Conclusion

Tax advisors are more than just number crunchers—they can be your strategic partners, dedicated to boosting your business’s efficiency, profitability, and longevity. By tapping into their expertise in financial planning, business structuring, tax strategy, exit readiness, and estate planning, you can build a solid foundation for your business’s immediate success and future growth. Our team at C&A has been supporting businesses and business owners for over 30 years, the team holds more than 25 professional designations, we'd love to help you.