There are many ways to leverage charitable giving to have a positive impact on your community and your estate. Here are a few to consider.

Understanding Charitable Lead Trusts

Charitable lead trusts are a giving strategy that allows you to support a charitable cause while still benefiting from the trust's income. By transferring assets to a trust, you can ensure regular payments are made to the charity of your choice for a set period. Once that time is up, the remaining assets can be distributed to your beneficiaries.

Key points to note about charitable lead trusts:

- This strategy enables you to make a significant impact on a charitable cause during your lifetime.

- The income from the trust paid to the charity is tax-deductible, providing additional benefits.

- Charitable lead trusts can help alleviate the estate tax burden on your beneficiaries, offering financial relief.

- You have the flexibility to choose how long the trust will make payments to the charity, giving you control.

- After the trust term concludes, the remaining assets can be passed on to your beneficiaries with potential tax advantages, ensuring a smooth transition.

Exploring Donor-advised Funds

A donor-advised fund allows you to establish a fund with a charitable organization and make recommendations on how the funds should be distributed. With a donor-advised fund, you contribute assets to the fund and receive an immediate tax deduction. You can then advise the fund on which charitable organizations or causes should receive grants.

Here are some key points about donor-advised funds:

- Donor-advised funds provide a convenient way to manage your charitable giving.

- You can make contributions to the fund at any time and receive an immediate tax deduction.

- You have the flexibility to recommend grants to the charitable organizations or causes you care about.

- Donor-advised funds offer the opportunity for your contributions to grow tax-free, allowing for even greater charitable impact.

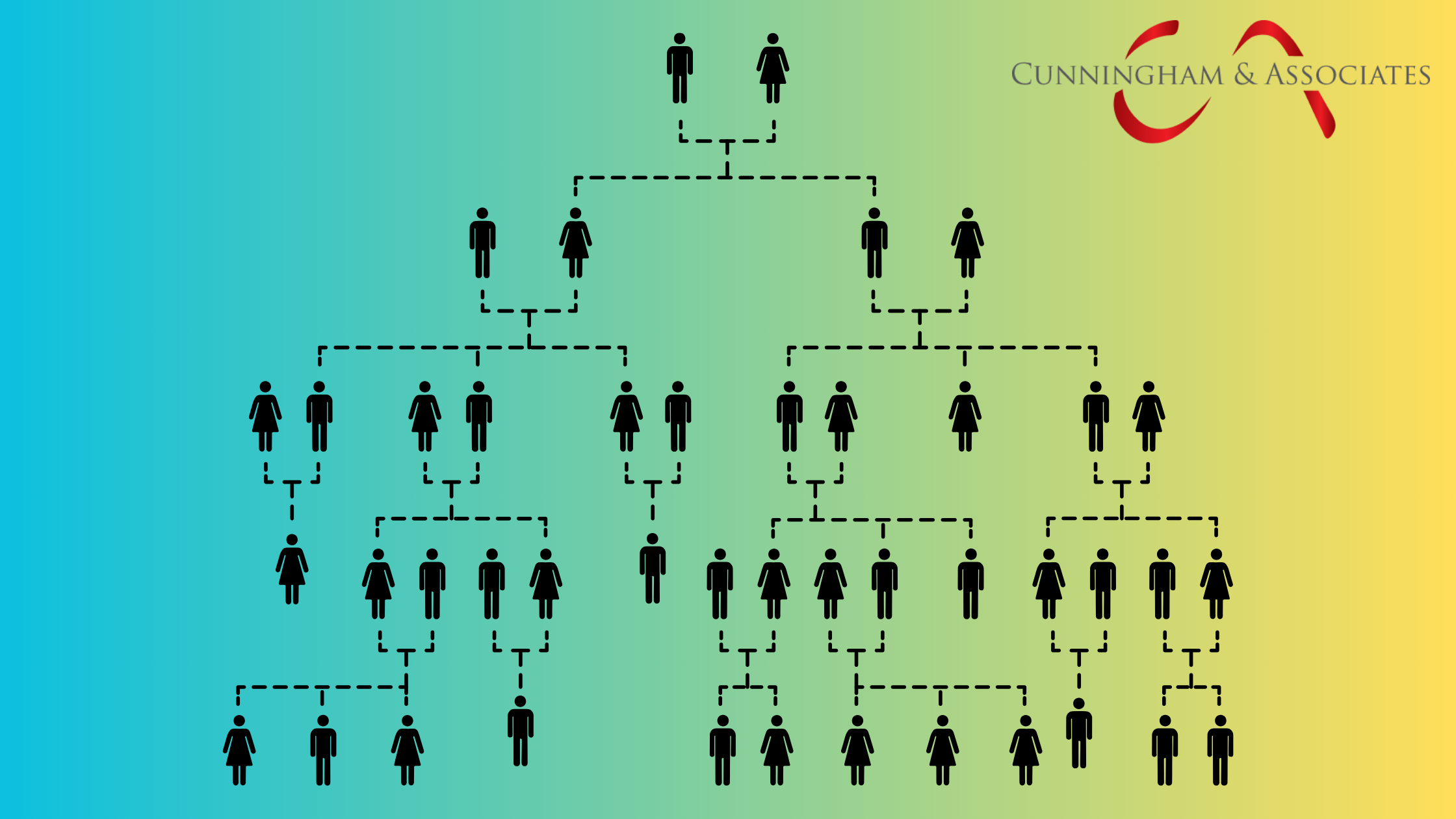

- Donor-advised funds can be used to involve your family in philanthropy and pass down charitable values to future generations.

Benefits of Charitable Remainder Trusts

Charitable remainder trusts offer a unique opportunity to receive income while also making a difference in a charitable cause. By transferring assets to the trust, you or your chosen beneficiaries can enjoy regular income payments for a specified period. Afterward, the remaining assets can be distributed to the charity of your choice.

Here are some advantages of charitable remainder trusts:

- You have the option to receive income for life or a set period, tailored to your financial needs.

- These trusts come with potential tax benefits, such as an immediate income tax deduction and savings on capital gains tax.

- By supporting a charitable cause through a remainder trust, you can create a lasting impact on a community or cause close to your heart.

- Charitable remainder trusts can also help in minimizing estate taxes and providing for your loved ones while still contributing to a charitable cause.

Tax Implications and Considerations

When exploring different giving strategies, it's crucial to grasp the tax implications and considerations at play. Seeking guidance from a financial advisor or tax professional is highly recommended to fully comprehend the potential tax benefits and repercussions of each giving strategy. Some key tax implications and considerations to bear in mind include:

- Charitable deductions: Numerous giving strategies provide tax deductions for contributions made to charitable organizations.

- Capital gains tax: Certain strategies, like donating appreciated securities, can result in savings on capital gains tax.

- Estate taxes: Specific giving strategies can aid in lowering estate taxes and potentially boosting the amount available for charitable giving.

- Required minimum distributions (RMDs): If you have a retirement account, you may need to take RMDs once you reach a certain age. Consider utilizing a giving strategy to fulfill your RMDs while also supporting charitable causes.

- Seek professional advice: Given the complexity of tax laws and regulations, it's wise to consult with a professional to ensure you optimize the tax benefits of your chosen giving strategy.

Choosing the Right Giving Strategy for You

Selecting the optimal giving strategy hinges on your unique financial circumstances, philanthropic objectives, and personal preferences. Take into account the following elements when picking a giving strategy:

- Impact: Assess how each strategy aligns with your ambitions and the effect you aim to achieve with your charitable donations.

- Flexibility: Determine the extent of control and adaptability you seek in managing your charitable contributions.

- Tax advantages: Grasp the potential tax benefits and implications of each strategy and how they integrate into your overall financial blueprint.

- Charitable passions: Ponder the causes or organizations that ignite your passion and how each giving strategy empowers you to champion them.

- Professional counsel: Seek input from financial advisors, tax experts, or philanthropic specialists who can offer advice and assist you in making a well-informed decision.

By thoughtfully weighing these considerations and exploring the array of giving strategies at your disposal, you can pinpoint the approach that best aligns with your philanthropic aspirations and amplifies the impact of your charitable contributions.

Have questions about how to incorporate giving strategies into your estate plan? Talk with our team today.